Our Investment Approach

A diversified portfolio and strong governance

CAAT takes very seriously our fiduciary responsibility to Plan members who depend on us for a reliable, lifetime retirement income. CAAT’s main investment goal is to maximize long-term, risk-adjusted returns to ensure that our members’ pensions remain secure.

Our investment team combines internal expertise and strategic capabilities with the selection of external managers to deliver long-term performance and value. This team identifies opportunities that will result in strong risk-adjusted returns based on careful consideration of the Plan’s long-term liabilities and liquidity requirements. The primary source of risk mitigation is a well-diversified portfolio that includes a broad range of public and private asset classes and return sources.

The guiding principles laid out in our Statement of Investment Policies and Procedures (SIPP) help ensure our assets are invested in a prudent and skillful manner.

Explore the menu to the left to find out more about our policies, asset mix, performance, team, and approach to responsible investing.

Our Investment Policies

The CAAT Plan's Statement of Investment Policies and Procedures (SIPP) serves as a blueprint for our investment strategy, which governs the management of the Plan and outlines our funding policy and our investment principles, beliefs and allocation of investment responsibilities.

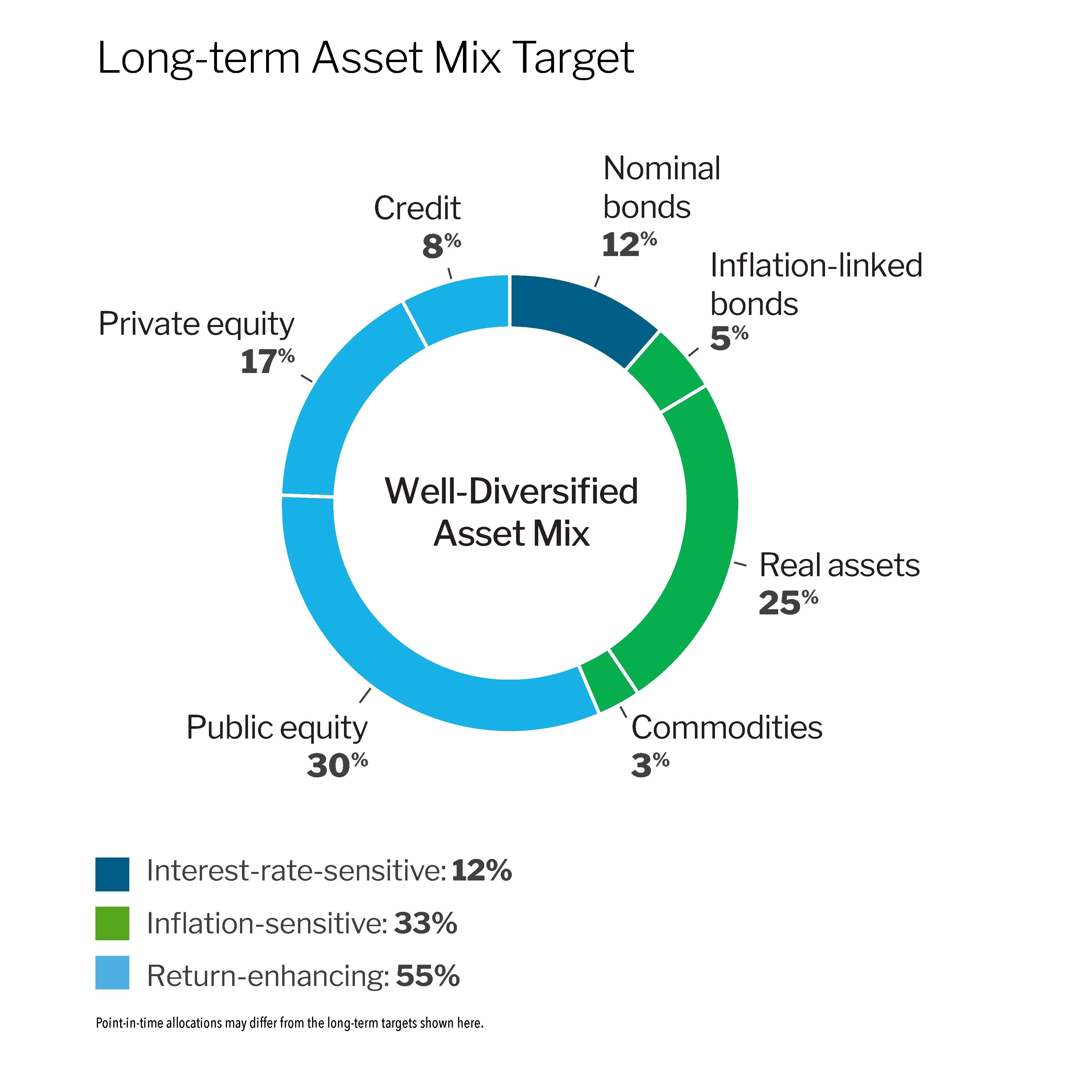

Asset Mix

At least once every three years, CAAT conducts an Asset-Liability Modelling (ALM) Study to identify the best possible asset mix for the Plan. The study takes into consideration the Plan's obligations, risk tolerance, and long-term return requirements.

The Plan’s diversified investment portfolio falls into three broad categories.

Point-in-time allocations may differ from the long-term targets shown here.

Our Team

The team oversees the Plan’s investment strategy as approved by the Board of Trustees, as well as the activities of a select group of external partners that employ a diversified mix of investment approaches across a wide array of asset classes.

Meet the team below.